Where does our soya come from?

By Dr Christian Bickert

In the EU, home-grown soybeans produce a harvest of some 3 million tonnes (m t) with German farmers alone harvesting around 90 000 t. Without doubt this is way below requirements for even one of the EU’s bigger livestock producing countries, let alone the whole union which needs around 32 m t soya meal annually, the equivalent of something in the order of 40 m t beans. Thus, without imports there wouldn’t be nearly enough of this protein source available. But which countries actually supply us with these beans?

»Soybeans come from the Americas«

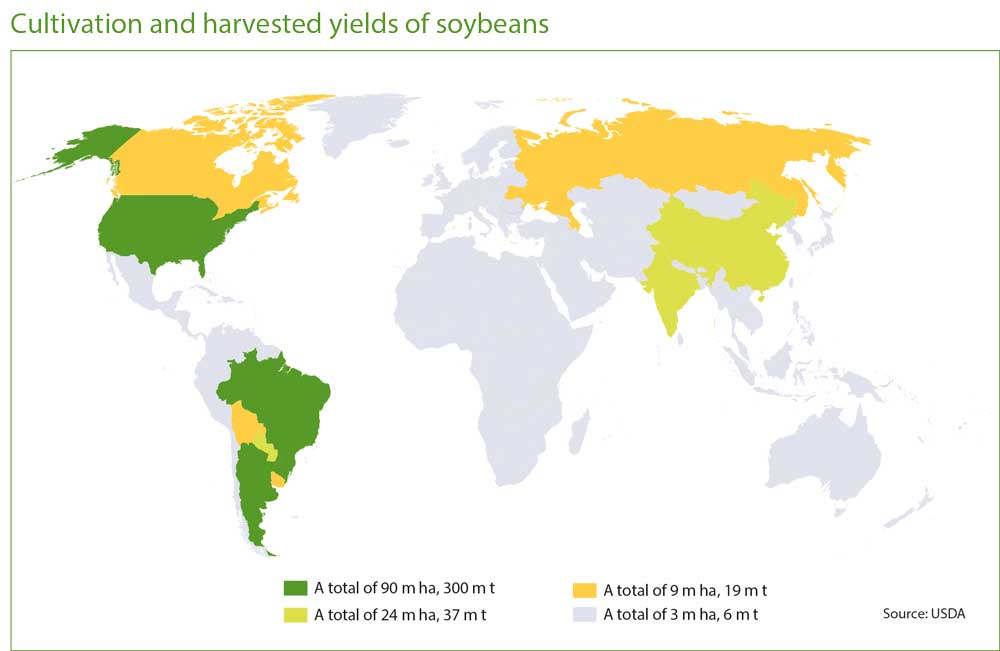

Soybeans grow on 128 m ha worldwide, of which 97 m ha are in North and South Americ. The US Department of Agriculture (USDA) estimates that only 31 m ha of the crop grows outside the New World. India and China grow a little over 21 m ha soybeans, leaving just 10 m ha of the protein-rich crop cultivated over the rest of the world. EU crop area is just short of 1 m ha. Russia and Ukraine together harvest the beans from 4.5 m ha. With that, the list of soybean producing lands is more or less complete.

New World output dominates

Yields are much higher on the far side of the Atlantic: not surprisingly because where most of the crop is grown, much of the breeding is also done. So farmers there drive home around 325 m t soybeans while the total from all other countries is just 45 m t, not even half of the Chinese requirement.

No matter how you look at it: over the long-term Europe will be forced to continue purchasing soybeans and meal from the USA, Brazil or Argentina. These three countries are very clearly the world »soya silos«. For the foreseeable future, there’s no way around this. Small amounts of global supply can come from Canada and Paraguay. All the remaining countries together export just 5 m t soya meal plus 4 m t soybeans: an amount that does not even cover half the EU consumption and not even a fraction of China’s requirements in this respect.

Soya production in Europe

So when we speak of soya cropping in the EU, or Germany for instance, we have to realise that we’ll always be competing with beans or meal from the USA, Brazil and Argentina. And competing against genetically modified (GM) crop, the European product has no chance on the market. South American soya pellets are available in the Lower Rhine region, or in the »Kanalgebiet«, a region of north Germany east of Münster networked by major commercial shipping canals, at 400 € (Brazilian) or 406 € (Argentinian) per tonne. Soybeans from the USA or Brazil are unloaded in Rotterdam at prices of from 410 to 415 €/t. Meanwhile, GM-free soybeans cost around 360 €/t at North Sea ports. This ware is exclusively from Brazil, because soybeans grown in the USA or Argentinian are practically all GM.

Looking at Germany, the largest processor of soybeans is Straubing oil mill, a facility well-located for imports of (GM-free) soybeans via the Danube from Romania, Hungary and Austria. Currently, the price for soybeans there is 385 €/t – tallying roughly with the import price less logistic costs to Lower Bavaria.

And logistics play a decisive role. All oil mills that process soybeans in Germany are located either directly at a seaport or are sited on rivers and canals. Transport to the respective mills is therefore relatively low cost – and further freight for the processed soya meal in Germany also saves costs by making use of this giant waterway network. Almost the only exceptions here are a few mills in Thuringia and Saxony not sited on major waterways.

However home-grown soybeans need to be trucked in small amounts from farms to merchants’ depots and then on to processors which tend to be the larger mills because local processors, such as the Kraichgau Raiffeisen Centre in Eppingen or Landhandel Diehl in Wölfersheim, have relatively small-scale facilities with capacities just in the hundreds of tonnes for toasting and oil separation.

Conclusion

Home-produced soybeans can either supply a special, usually local, market - or else they must compete on the open market with GM-free deliveries from Brazil or South-eastern Europe. While European-produced soya ware earns a price premium over GM products from North of South America, the market development is in no way independent from world market prices. Based on a quoted September 2020 price of 385 €/t from the Straubing mill in Germany, home-growers of soybeans can only expect little more than 355 € to 375 €/t for their beans when delivering to merchants’ depots.